- By Vanshika Choudhary

- November 13, 2025

Expanding one’s small business to a foreign market can be considered a great move. But, for many applications, the word “customs” brings stress. From complicated forms to unpredictable taxes, customs are probably regarded as a very tough issue to cope with. Despite all the right steps taken in advance and adequate knowledge gained, you would still be able to treat customs clearing as a barrier-free and easy part of your journey towards world trade.

The following blog will take you through some practical ways to ease customs for small businesses with no stress, no waiting, and no extra costs.

-

Basic Knowledge of Customs Procedures

Getting into international trade means that you really need to know the inner workings of customs, so to speak. Customs departments exercise authority over imports and exports of the country, ensuring that all goods comply with the applicable laws and regulations.

To each product is designated an HS (Harmonized System) code that indicates how much tax or duty is to be paid. It is very important to know the exact HS code because if one uses the wrong one, it might end up in fines or even delays at the border. Also, you have to be honest about the price and the place of origin of your products. Misleading information on these points can cause the authorities to suspect you and thus attract unnecessary hassle.

Without doubt, this knowledge will be the basis for a small business’s stress-free shipping. One by one, you will find the basic customs processes—inspection, declaration, and payment of duties—easier to cope with, and thus fewer surprises will come your way if you make the appropriate preparations.

-

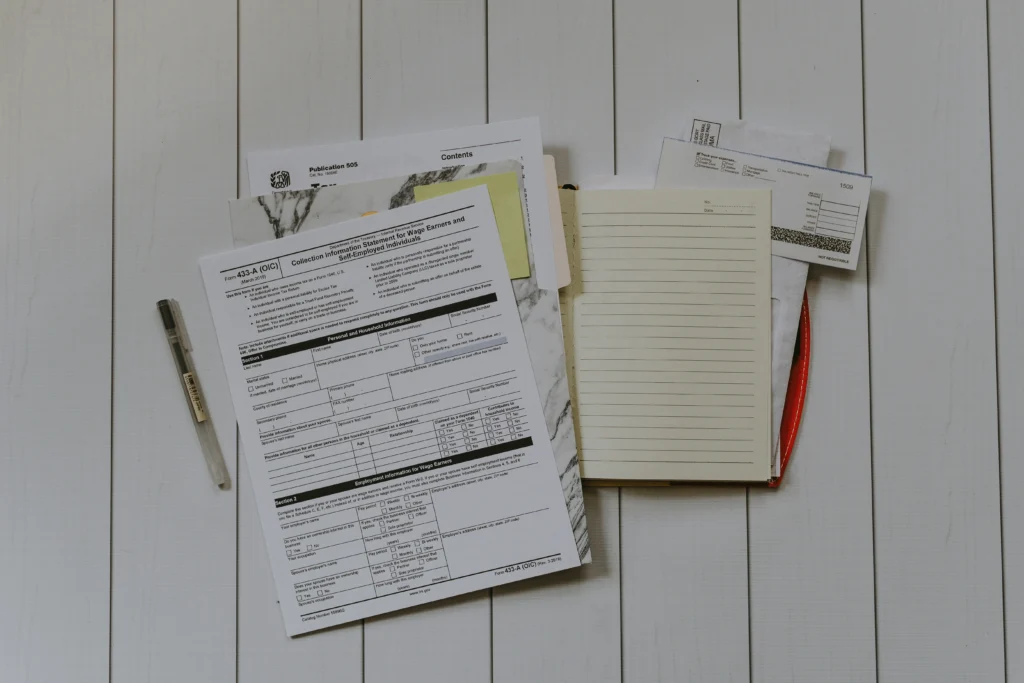

Prepare Accurate and Complete Documentation

The most common reason for customs delays experienced by small businesses is incomplete or incorrect paperwork. Customs officers depend completely on documentation to validate what is being imported or exported. If even a tiny bit of information is missing or not consistent, your goods can be waiting till the problem is resolved, and this can lead to a loss of time and money on your part.

Among the major documents required are a commercial invoice, which gives details about the products and their worth; a packing list, which indicates what is in each shipment; and a bill of lading or airway bill as evidence of transportation. In the case of some products, a certificate of origin would also be necessary to prove where the product is from, especially in cases where free trade agreements or tariffs are involved.

Always inspect these documents for correctness and uniformity. This easy practice helps to make the customs process smoother and to build a trustworthy record with customs and logistics partners.

-

Work with a Reliable Customs Broker

An alliance with a customs broker could change the scenario for small businesses that are entering global trade for the first time. A customs broker is a professional who knows the very details of the import/export regulations and assists the business in getting the goods through customs quickly and properly.

When it comes to customs brokers, they have a lot to offer in terms of support, especially if you are the one trying to work with several different countries with various trade laws. They can help you decipher difficult tariff rules, assist with the proper classification of your products, and even recommend some cost-saving methods that are still legal through trade agreements or exemptions.

On one hand, employing a broker can be quite pricey; on the other hand, it is often much cheaper than dealing with penalties or shipping delays. To put it differently, brokers eliminate your disappointments, incorrect paperwork, and your worries—hence, they let you divert more resources to your business growth rather than compliance.

-

Stay Updated with Trade Regulations

One cannot expect trade policies, import restrictions, and tariff rates to change without any prior warning. A small business that does not keep track of such changes might find itself unintentionally out of compliance. This is the very reason why keeping oneself informed about the latest customs and trade updates is vital.

To begin with, you can sign up for newsletters from your country’s trade authority or international trade portals. Official newsletters of the customs of your country are also a good source that provides trade updates. Industry associations usually keep publishing regular updates, which help small businesses to be aware of changing documentation needs, new tax regimes, or restricted goods. Check out our latest blog post on What Is a Customs Broker and Why Do You Need One.

-

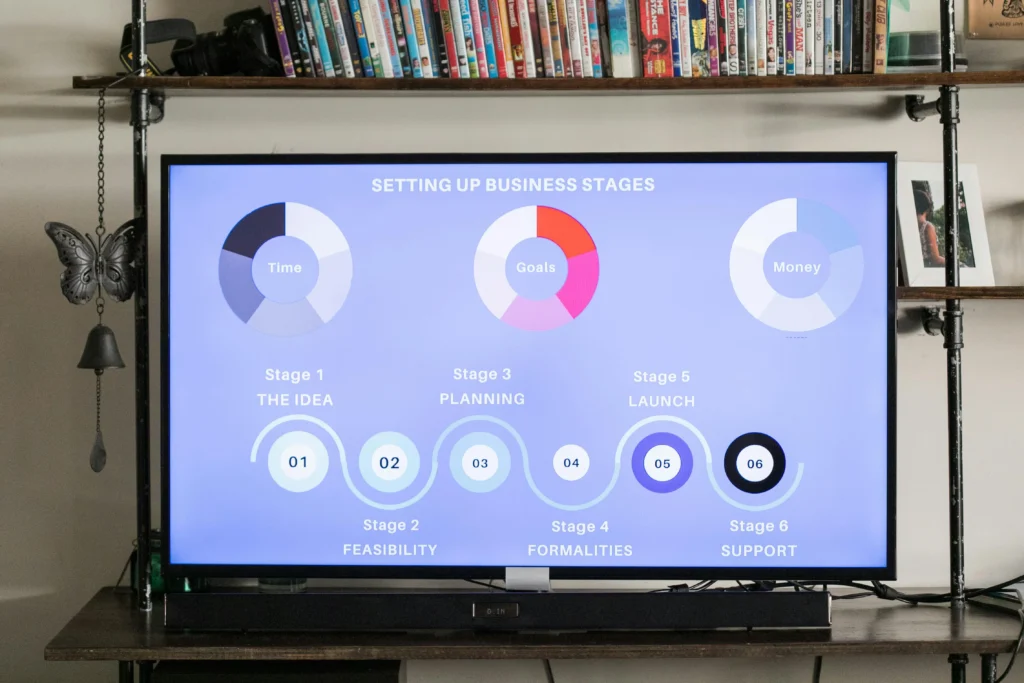

Use Technology to Simplify the Process

To date, technology has entirely changed the manner in which small businesses process customs and logistics. Today, digital instruments not only open but also find ways to manage the documentation, taxing, and tracking of shipments—all within a single location.

Just to illustrate, leading courier companies such as DHL, FedEx, and UPS have included customs clearance features within their operations. They do this by generating shipping labels, commercial invoices, and electronic customs declarations automatically. On top of that, you can even engage AI-based duty calculators for tax estimation before the actual shipping of your goods, thus making your product pricing more accurate for the international market.

Moreover, the use of customs management software can facilitate the storage of product details, automation of repetitive processes, and reduction of human error. This indeed has a great impact on small businesses, as it smooths their operations and minimizes the chance of last-minute customs surprises.

-

Anticipate Delays and Maintain Communication

Sometimes, customs would still delay, although everything else was in order. Random checks, non-working days, or wrong data input by carriers are some of the reasons that can lead to a temporary hold on your shipment. This can be quite annoying, but it is an experience that every exporter or importer goes through at least once. The trick is to be ready and to communicate well.

The very first thing you need to do is to create a buffer time for your delivery. Making a provision for small delays will not affect your customer commitments. You have to stay in very close touch with your shipping carrier or customs broker in order to get the real-time updates on the status of your shipment. In case there is a delay, you must inform your customers beforehand—it builds trust and shows professionalism.

Keep in mind that being calm and making things clear are two very important factors in international trade. Being ready for delays lets you remain bold, keep customer relations, and fix problems more quickly.

Conclusion

Customs clearance doesn’t show up as one of the main stressors in the life of a small business. When you follow the basic rules, provide accurate documentation, and let either an expert or a machine do the rest, the whole experience will be much less daunting. To sum up, it takes knowledge, organization, and, above all, a good dose of preparation to get through customs without a foul-up.

If the future of your small business is to be a global one, then it is time for you to start working on your customs strategy. Understand the rules, sort out your documents, check out technology, contact us, and ask for expert advice. Every successful export starts off with preparation—And the world will be ready to receive your products once you’re ready to ship them with confidence!